does texas have an estate tax

However Texas is not one of those states. Its her fourth try.

Talking Taxes Estate Tax Texas Agriculture Law

Estate tax of 112 percent to 16 percent on estates above 43 million.

. Counties in Texas collect an average of 181 of a propertys assesed fair. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas has no income tax and it doesnt tax estates either.

If your estate is worth 1756000. The rate increases to 075 for other non. Ballot measure 84 which would have repealed oregons estate tax was defeated in november 2012.

In fact only New Jersey Nebraska Maryland Kentucky Iowa and Pennsylvania collect estate taxes. 16 hours agoTexas Comptroller Glenn Hager reported that taxes on feminine hygiene products generate 286 million annually but even he advocates for eliminating it. While its very beneficial that Texas doesnt have a transfer tax it does come at an expense.

Estate tax of 116 percent to 12 percent on estates above 91 million. The state of texas does not have an inheritance tax. There is a 40 percent federal tax however on estates.

The state of Texas is not one. Therefore Texans will only have to worry about the federal estate tax on their properties. As of 2019 only twelve states collect an inheritance tax.

However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased. Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005. This type of tax used to be normal in the United States both at the federal and state levels.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. The sales tax is 625 at the state level and local taxes can be added. This is because the amount is.

Fortunately Texas is one of the 39 states that does not have an estate tax. Texas has some of the highest property taxes in the entire country. Does Texas have an estate tax.

Texas does not have an estate tax either. How High Are Property Taxes in Your State. So until and unless the Texas legislature changes the law.

Any estate taxes are paid out of the estates funds before distribution of those assets. But 17 states and the. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

Its inheritance tax was repealed in 2015. The basic exclusion amount is increasing from 1206 million in 2022 to 1292 million in 2023 the largest adjustment the exclusion has ever received. Texas is one of the states that do not collect estate taxes.

In Texas the federal estate tax limits apply. In 2018 the thresholds for a single persons Texas estate tax were estimated. Donna Howard seen here at the Capitol in 2019 filed a bill on Monday to eliminate the tax on feminine hygiene products in Texas.

You are subject to pay 2545800 in federal estate taxes. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. Some states have estate taxes too.

Your executor will file an estate tax return with the IRS and pay any taxes due. When paired with local taxes total sales taxes in some jurisdictions are as high as 825. People with a small.

There are different thresholds for state estate taxes.

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Estate Tax Rates Forms For 2022 State By State Table

Charitable Lead Trusts 2 Estate Tax Calculations Youtube

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

Texas Attorney General Opinion Ww 1134 The Portal To Texas History

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Tax Planning Boerne Estate Planning Law Firm

How To File Estate Tax 14 Steps With Pictures Wikihow Legal

Why Republicans Want A Bigger U S Estate Tax Repeal Than Ever Bloomberg

Talking Taxes An Educational Discussion Of The Estate Tax The Gift Tax And The Capital Gains Tax By A Texas A M Expert

The Complete Guide To Planning Your Estate In Texas A Step By Step Plan To Protect Your Assets Limit Your Taxes And Ensure Your Wishes Are Fulfilled For Texas Residents Ashar Linda C 9781601384263

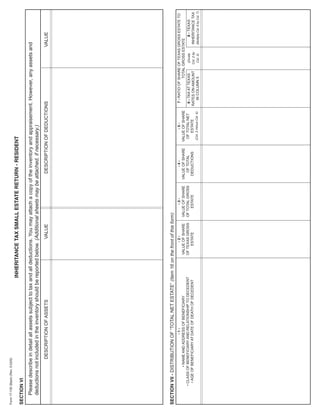

Afpc Analyzes Proposed Tax Change Impact On Representative Farms Texas Agriculture Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It